How sound data analytics practices can save you from the latter.

In business, data is king. The more data you have, the better forecasting you can do, right? And the better decisions you can make, right? Not necessarily. Even with mountains of data at your disposal, it’s not always easy to tease out the insights you need to make sound financial forecasting decisions.

That’s where data analytics comes in. By using the right tools and approaches, you can make sense of all that data and extract the most meaningful insights. This can help you stay ahead of your competition and ensure optimum business performance.

Of course, data analytics is only useful if it’s done accurately. If your data is inaccurate or incomplete, it can lead to faulty forecasting and, ultimately, failure. So be sure to use reliable data sources and employ sound analytics practices.

How can businesses identify the forecasting elements most pertinent to their success?

There is no one-size-fits-all answer to this question, as the key performance indicators (KPIs) that are most important for a business will vary depending on the industry and sector. However, some general financial metrics are always worth tracking.

The most important financial KPIs include revenue, profit, gross margin, operating margin, and EBITDA. By tracking these metrics, businesses get a good sense of how they are performing financially and where they need to make improvements.

It’s also important to track key performance indicators that are specific to your industry. For example, in the financial services sector, it is paramount to track customer churn or loan default rates. In the industrial sector, it is crucial to measure inventory turnover or days sales outstanding. The key is to identify the financial metrics that are most relevant to your business and track them regularly. This will help you make sound financial forecasts and ensure that your business is on a path to success.

Businesses also benefit from forecasting tools and models that help them predict future performance. Forecasting gives businesses a better understanding of how changes in key metrics will impact their bottom line. This helps businesses make more informed decisions about where to allocate their resources and how to grow their business.

What forecasting model is best for a product or service?

Deciding on a forecasting model should be based on the type of demand that exists for a product or service. A weather forecasting analogy can help illustrate this point. Predicting sunrise and sunset times for any given day of the year is a straightforward practice given historical data and the consistency of the variables. Predicting extreme weather events like category five tornados and hurricanes proves to be significantly more challenging due to the more erratic nature and degrees of variable combinations. The best people at predicting the weather aren’t limiting themselves to the moon, sun and stars to look into the future and provide meaningful insight. They use all the tools at their disposal.

The current business environment can have very predictable demand schedules, as well as the unpredictability of a catastrophic storm. From the mundane to the emergency and everything in between, classifying demand can be just as important to a business as the actual forecasting. One common demand classification structure breaks historical data into quadrants: smooth, intermittent, lumpy, and erratic. You will likely want to use a different forecast model for each quadrant, depending on the type of product or service you offer and how your business operates.

That is why it is important to have a good understanding of your business operations, the products, or services you offer, and the demand classification of individual products and services offered. By identifying the right demand classification, you can select the most predictive forecasting model or none. This isn’t quite “The Gambler” by Kenny Rodgers, but knowing when to walk (or run) away from repeated attempts to predict the largely unpredictable elements of your business can free up resources that will provide value in the most beneficial areas.

How can Sea Cliff help?

At Sea Cliff, we have the analytics tools to take historical data and classify demand for your goods and services into the four quadrants mentioned above. In minutes, the model analyzes as far back as a company wants to look, in order to bin products and services according to demand. Our team of seasoned analysts can then provide decades of business insight to work by mapping out a strategy to maximize forecasting processes and resources. Corporate Finance – Sea Cliff Consulting

So, while data alone does not a king make. He who masters his data is likely to be king.

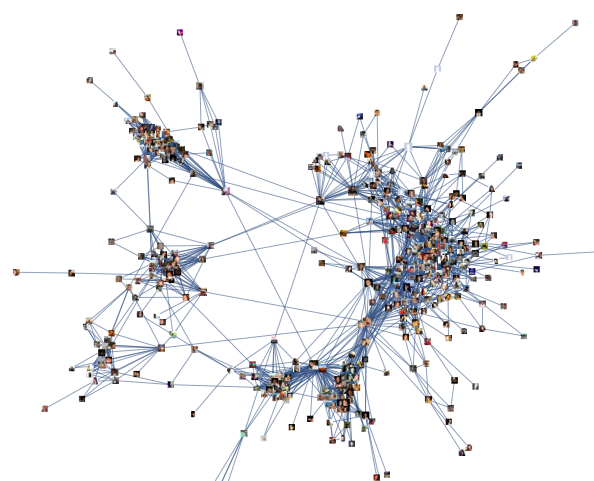

Connect with Sea Cliff Consulting on LinkedIn to stay up to date with the latest on industry best practices along with providing feedback on what content you would like to see next.